Understanding Forex Currency Market Trading: A Comprehensive Guide

The Forex currency market, also known as the foreign exchange market, is one of the largest and most liquid financial markets in the world. It operates 24 hours a day, five days a week, and is vital for facilitating global trade and investment. For those looking to engage in this dynamic market, it’s essential to understand its mechanics and employ proper strategies. In this guide, we will delve into various aspects of Forex trading, including its basics, strategies, tools, and tips for selecting the right brokers, such as forex currency market trading MT5 Forex Brokers.

The Basics of Forex Trading

At its core, Forex trading involves the buying and selling of currency pairs. When you trade in the Forex market, you are simultaneously purchasing one currency while selling another. Currency pairs are typically classified into three categories: major, minor, and exotic pairs. Major pairs consist of the most traded currencies, such as the Euro (EUR) against the U.S. Dollar (USD), while minor pairs involve other currencies excluding the USD. Exotic pairs include a major currency paired with a currency from a developing economy.

Forex trading is often facilitated through brokers, who act as intermediaries between traders and the market. The spread represents the difference between the buying and selling price of a currency pair, and it is how brokers earn their income. Understanding pricing, spreads, and market volatility is crucial for successful trading.

Types of Forex Trading Strategies

There are various strategies that traders use in the Forex market. Each strategy has its merits and is suitable for different trading styles and risk tolerances. Some of the most common types of Forex trading strategies include:

1. Day Trading

Day trading involves making multiple trades within a single day, aiming to capitalize on small price movements. Day traders rely on technical analysis and real-time market data. They typically close all positions by the end of the trading day to avoid overnight risk.

2. Swing Trading

Swing trading is a medium-term trading strategy where traders hold positions for several days to weeks. This strategy takes advantage of price swings and trends in the market. Swing traders usually rely on a combination of technical and fundamental analysis to identify potential trades.

3. Scalping

Scalping is a strategy that focuses on making a large number of trades over short periods, usually seconds to minutes. Scalpers aim to profit from tiny price movements and may execute dozens or even hundreds of trades in a day.

4. Position Trading

Position trading is a long-term strategy where traders hold positions for weeks, months, or even years. This strategy is less concerned with short-term price movements and more focused on the overall trend. Position traders typically use fundamental analysis to make their trading decisions.

Tools and Resources for Forex Trading

Successful Forex trading requires an array of tools and resources. Here are some of the key tools that every forex trader should consider:

1. Charting Software

Charting software is essential for analyzing market trends and price action. Most trading platforms come equipped with advanced charting tools. MT5 platforms, for example, provide traders with a range of technical indicators and graphical tools to help inform their trading decisions.

2. Economic Calendars

An economic calendar is a vital resource that lists upcoming economic events, such as central bank meetings, employment reports, and inflation data. Staying informed about these events is crucial as they can significantly impact currency prices.

3. Forex News Sources

Staying updated with the latest Forex news helps traders react quickly to market changes. Reliable news sources can provide insights into market sentiment and factors affecting currency valuations.

Selecting the Right Forex Broker

Choosing a reliable Forex broker is one of the most critical steps for any trader. Your broker can significantly affect your trading experience and success. Here are some factors to consider when selecting a Forex broker:

1. Regulation

Always choose a broker that is regulated by a reputable authority. Regulation offers a level of protection to clients and ensures that brokers adhere to industry standards.

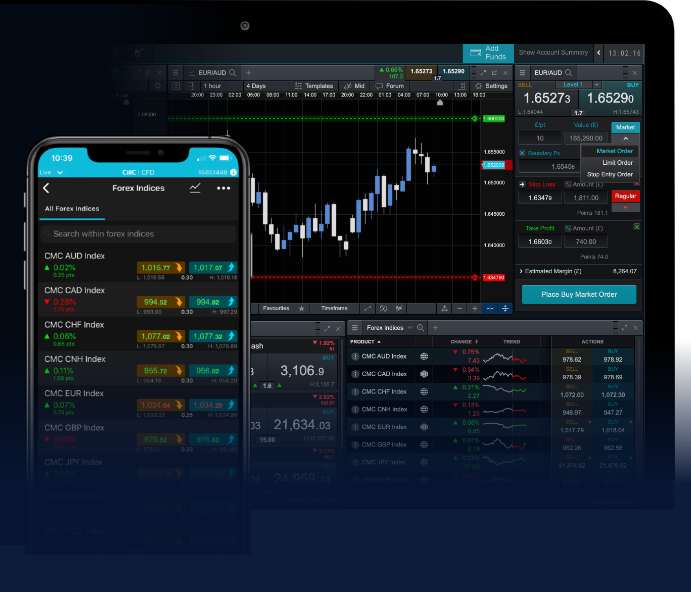

2. Trading Platform

Your broker’s trading platform should be user-friendly and equipped with the tools you need to trade effectively. Look for features such as automated trading, technical analysis capabilities, and customization options.

3. Spreads and Fees

Compare different brokers’ spreads and fees. Low spreads are preferable, especially for day traders and scalpers who rely on quick price movements for profits.

4. Customer Support

Reliable customer support is essential, particularly for new traders. Ensure that your broker offers multiple contact methods and has a reputation for responsive service.

Common Mistakes in Forex Trading

Even experienced traders can make mistakes that impact their trading success. Here are some common pitfalls to avoid:

1. Lack of a Trading Plan

For many traders, entering the market without a clear trading plan can lead to poor decision-making. A solid trading plan includes entry and exit strategies, risk management guidelines, and specific trading goals.

2. Over-Leveraging

While leverage can amplify profits, it also increases the potential for significant losses. Many traders fall into the trap of over-leveraging, which can result in losing more than their initial investment. It’s crucial to use leverage judiciously and understand the risks involved.

3. Emotional Trading

Letting emotions guide trading decisions can be detrimental. Fear and greed can lead to impulsive actions, resulting in losses. It’s essential to stick to your trading plan and remain disciplined.

Conclusion

Forex currency market trading offers numerous opportunities for profit, but it also comes with inherent risks. Understanding the market’s mechanics, employing effective strategies, leveraging the right tools, and selecting a reputable broker are crucial steps for those looking to succeed in Forex trading. By avoiding common mistakes and continuously educating yourself, you can enhance your trading prowess and navigate this exciting financial arena effectively.